Manufactured Housing

Levenfeld Pearlstein’s Manufactured Housing team is dedicated to advising institutional owner-operators, entrepreneurial investors, and other players nationwide through middle-market transactions in the manufactured housing sector. We understand the characteristics unique to this niche in the real estate market and take a business-oriented approach to identify and resolve challenges, deliver cost-efficient advising, and protect our clients’ interests.

How We Deliver Value

We understand the nuances of due diligence in this niche. Due diligence for manufactured housing deals often involves evaluating existing infrastructure and inventory, understanding applicable zoning laws, and identifying potential insurance challenges, in addition to conducting general financial and market analysis. Our significant experience in this space prepares our clients to make prudent investing decisions.

We staff for efficiency. Every member of our team, from the partners to the paralegals, is highly experienced with the distinct lines of business involved in manufactured housing, including lease

agreements, sales of homes, and consumer financing. Our team hits the ground running on every matter. Partners advise on high-level strategy, and associates and paralegals facilitate the production and

execution of key documents to ensure our clients receive excellent value throughout the representation.

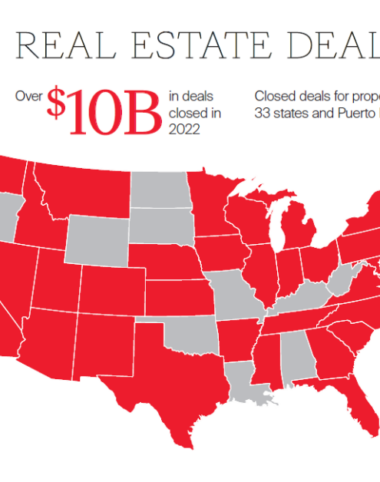

Our practice is truly national. The LP team represents manufactured housing clients across the country. We are familiar with the state-by-state rules and nuances of regional manufactured housing markets, and our strong relationships with local counsel and advisors in each of these states ensure our clients always receive up-to-date advising. For clients with holdings in multiple markets, our team provides continuity and comprehensive advising tailored to the unique aspects of each location and business goal.

Your LP Contacts

Keith A. Ross

Partner,

Real Estate

kross@lplegal.com

Juliann S. Hathaway

Partner,

Real Estate

jhathaway@lplegal.com

Lauren F. Easoz

Paralegal,

Real Estate

leasoz@lplegal.com

William H. Schriver

Partner,

Real Estate

wschriver@lplegal.com

Michael G. Yip

Associate,

Real Estate

myip@lplegal.com

Katie M. Haas

Paralegal,

Real Estate

khaas@lplegal.com