Adam S. Garber

Partner

Trusts & Estates

Adam Garber is a partner in the firm's Trusts & Estates Group, where he focuses on providing families with the tools necessary to transfer their assets from one generation to the next. Adam understands that there is no such thing as a "one-size-fits-all" approach to estate planning. Each family and family business has its own unique set of circumstances. Adam tries to dig deep into each family's unique situation to craft a tailored plan that will best suit their needs. He also understands that estate planning is about real people. His first priority is ensuring his clients' wishes are met in the most effective way.

More specifically, Adam's practice involves helping family business owners handle their daily challenges as well as plan for the succession of their businesses. Licensed as a certified public accountant as well as an attorney with an LL.M in taxation, Adam brings particular insight into tax issues as they relate to asset planning, and has extensive experience drafting wills, trusts, and other estate-planning documents. Adam’s practice also involves a wide scope of financial, estate and tax planning matters as they relate to business and asset ownership in various forms.

Adam is a member of the esteemed estate planning organization, the American College of Trust and Estate Counsel (ACTEC). ACTEC membership is based on professional reputation, expertise in the fields of trusts and estates and on the basis of having made substantial contributions to these fields through lecturing, writing, teaching and bar activities.

Adam previously worked at a large Chicago firm where he handled all aspects of estate planning with a focus on the tax compliance aspects of an estate plan. He regularly prepared estate, gift, and generation-skipping transfer tax returns. He also defended estates under audit by the Internal Revenue Service. Adam also supervised estate administration from the opening of probate through the ultimate implementation of the estate plan.

Adam partners with North Suburban Legal Aid Clinic providing free Power of Attorney to college students.

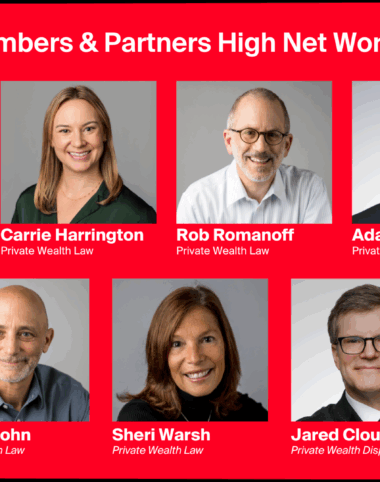

Adam has been recognized individually in Chambers High Net Worth Guide, with references noting that he is a “terrific blend of sophisticated legal knowledge, responsiveness, efficiency and likability.”

Additional Information

Education & Admissions

Education

- Northwestern University School of Law, LL.M. in Taxation, with honors

- Chicago-Kent College of Law, J.D., with honors

- University of Illinois, Urbana-Champaign, Accounting and Finance, B.S., with honors

- Certified Public Accountant

Bar Admissions

- Illinois

Memberships

- Past Chair of the Chicago Bar Association Trust Law Committee

- American College of Trust and Estate Counsel

- Prior Board Member of Anti-Defamation League Board

- Crohn's & Colitis Foundation

- Ben Gurion Society – Jewish United Fund

- Chair of the Professional Advisory Committee – Jewish United Fund

- Board Member of Glencoe Writers Theater

Awards

- Ranked in Chambers High Net Worth Guide 2021-2025

- 40 Illinois Attorneys Under Forty, Law Bulletin Publishing Company, 2019

- Illinois Super Lawyer, 2017-2025

- Chicago Bar Association Outstanding Tax Student Award Recipient

- CALI Award: Legal Writing IV

Q&A

If you weren’t an attorney, what would you be?

I would be an accountant. I love to follow rules.What was the first concert you went to?

Chicago and the Beach BoysWhat was your very first job?

Unloader of groceries onto the conveyor belt at Sunset Foods.

“I also wanted to thank you for your professionalism and for making it extremely easy for us to work through the overall process. I look forward to continuing to work with you and LP in the future.”