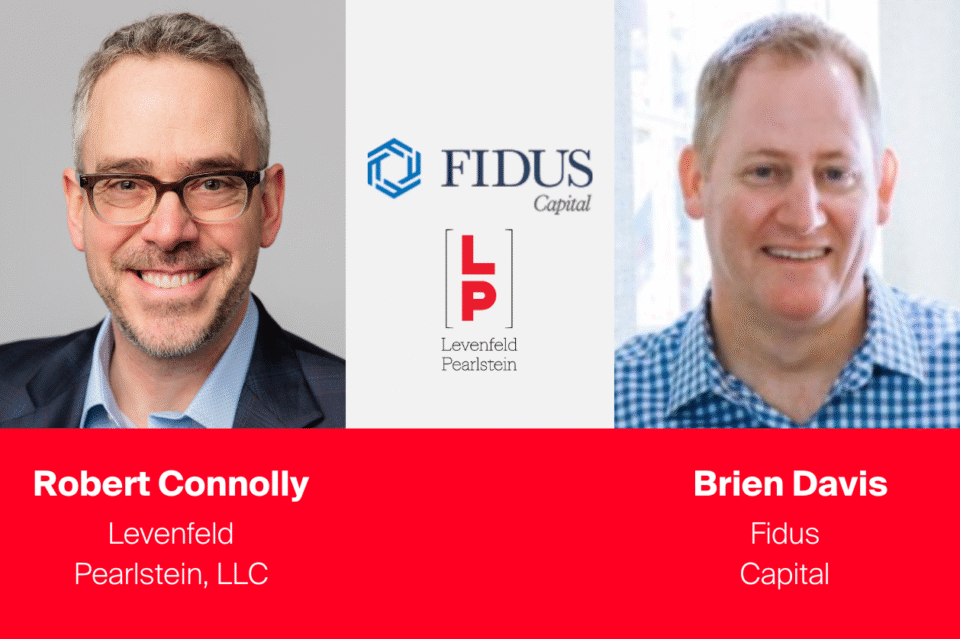

Independent Sponsor Series: Brien Davis of Fidus Capital Discusses Financing Options for Independent Sponsor Transactions

To help businesses, investors, and deal professionals better understand the evolving independent sponsor landscape, Robert Connolly – a partner in LP’s Corporate Practice Group and leader of LP’s Independent Sponsor team – shares a series of conversations with independent sponsors, capital providers, and other professionals.

Below is his conversation with Brien Davis, a Managing Director at Fidus Capital, which provides private capital solutions for the lower middle market. Brien has over 25 years of private debt and equity investment and origination experience in middle market companies. Before joining Fidus, he was the co-founder of Altacrest Capital, an independent sponsor private equity firm. In this interview, Brien shares insights on Fidus Capital’s investment approach, what makes an ideal independent sponsor investment, and the current environment for independent sponsor transactions.

The responses below have been edited slightly for brevity and clarity.

Can you provide an overview of Fidus Capital and its investment approach?

Fidus has been around close to 20 years. Historically, we’ve focused on providing debt and equity co-invest solutions to PE groups in the traditional committed fund arena, as that’s where our DNA was cut. Over that period, we’ve completed over 200 platform investments. We’ve also completed over 20 independent sponsor deals and realized that the independent sponsor world is becoming more sophisticated and capturing more market share in the lower middle market. I joined the firm a little over a year ago to lead our independent sponsor effort and to structure the growth of our investment activity in the space.

When we get involved in transactions, we have multiple pools of capital we can bring to bear. We have a publicly traded BDC, an SBIC fund, and a private capital fund. We have deep capital capabilities and approach transactions with the experience of working in the traditional committed fund area. In that world there’s a lot of add-on activity, and there’s a high and fast execution bar that we hit, as well as a high service level. We understand J-curves. We understand value creation plans and how they don’t always go straight up and to the right; sometimes, they take time to come to fruition. We bring that expertise into the independent sponsor world, and I use my background as a former independent sponsor to help lead that effort and craft more solutions for this community.

What are your investment criteria for deal selection? What’s your ideal EBITDA range or transaction size sweet spot?

We typically get involved by providing all the debt in a transaction and doing an equity co-invest. On the debt side, our involvement can take various forms, but the most common is a uni-tranche facility that includes a revolver, a term loan, and potentially an accordion or other mechanism to help fund growth initiatives. We tend to start with companies that have a minimum EBITDA of $3 million and go up to about $40 million EBITDA. The majority of what we do on the front end with independent sponsors is in the $3-15 million range, starting with investment amounts as low as $10 million. One of the things that differentiates us is that we can quickly scale our uni-tranche facilities up to $100 million in investment size but have stretched north of even that amount on a handful of occasions.

We invest in a variety of industries. We’ve done a substantial number of transactions in business services, niche manufacturing, healthcare, technology, tech-enabled services, aerospace, and defense. We’re less active in retail and restaurants. Because we’ve been around for a long time and worked on over 200 platforms, we have extensive expertise in many industries.

Can you talk about helping sponsors with scaling up?

I can give an example. We have a very strong relationship with an independent sponsor based in the Southeast. Their initial platform was an essential home services business with EBITDA of about $3 million. We got into that deal about two years ago and have since completed multiple add-on acquisitions, scaling the company to many times its initial size. As a result, the business is now an order of magnitude larger than when we first invested and they have not had to change financial partners.

They had a great lineup of add-ons and an identified pipeline. They’re a highly skilled independent sponsor with an excellent track record of integrating a buy-and-build strategy, so we’ve continued to aggressively fund their acquisitions within that space. As a result, we’re approaching a facility size closer to the $100 million mark than the $10 million mark.

What is the ideal independent sponsor partner? What makes an independent sponsor stand out in your selection process?

We don’t have a hard and fast rule on what we’re looking for in an independent sponsor. The deal I closed last week was like one I closed a couple of months earlier. Both involved former 20-year private equity professionals who decided to go out on their own as independent sponsors through the deal-by-deal method. They had very strong track records and industry expertise in verticals where they had invested in the past. We were excited to partner up with them.

That said, we’ve also worked with many younger groups, betting on the intellectual horsepower and capabilities of the individuals involved. Their track record may not be as developed as some of the other groups we’ve worked with, but they’ve done a good job of identifying a very attractive transaction and have demonstrated an ability to drive the value creation process.

It’s important for independent sponsors to know that you’re underwriting and evaluating both them and the transaction. We have to be comfortable with both to move forward with the deal. We’ve had some groups we really liked, but they might have been looking at an industry we see a little differently because we’ve had some challenges there in the past. We’ve also been in situations where we had an attractive company, but the independent sponsor hadn’t clearly demonstrated how they would drive the company’s value creation plan, appearing more focused on simply closing the deal. So, we spend time looking at both the independent sponsor and the transaction.

I’m a big believer that independent sponsors need to have a reason they are the optimal owner of that business. For instance, they might be thesis driven, they’ve done a lot of work in the sector, they have an excellent pipeline they’re going to use to execute a buy-build strategy, or they know where the real risks are and they know how to construct a business that mitigates those risks and positions the company for a sale in 5-7 years at a higher multiple. Having operating partners who can help with day-to-day operations or, at a minimum, at the board level with some real economic skin in the game is also very attractive to us because it shows that this group has a reason to own the business. Frankly, we find that groups with that type of strategy find the best value too. It doesn’t mean it’s a low purchase multiple; it just means it’s a very reasonable one, and the seller selected them because they’re excited about their next bite of the apple.

Building on that, what other advice do you have for those considering entering the market as an independent sponsor?

The first thing I tell people when they come into this market is to focus on how they’re sourcing transaction opportunities. There’s no doubt that good deals get financed. You can attract equity and debt financing if you have an attractive business with recurring revenues, some degree of a moat, and a reasonable valuation. We often see groups focus on deal sourcing with a heavy proprietary angle, with a lot of direct calling and/or hiring a buy-side firm to help them reach out to prospects. Another strategy that can work is to go through boutique investment bankers. In this strategy, you want to avoid being another “me too call” by showing the banker you have some real chops in the target industry and are the right owner for this asset. If that message can be credibly conveyed bankers are happy to include you in the process.

You have to focus on your niche and how you’re going to source deals. Part of that is being thesis-driven and knowing how you’re going to create value over the 3-7 years you own the business.

What advice do you have for an independent sponsor preparing to approach Fidus or other capital providers?

It’s important to work with people who understand the independent sponsor world. Some people are not familiar with certain aspects of economics and governance mechanisms, so having a deep understanding of the ecosystem is very helpful.

Focusing on groups that really know your industry is also important. This is a marriage you’re going to be in for a while, and if there are bumps in the road and they don’t know your industry well, it’s harder to right the ship if you’re not all on the same page.

And you need to talk to people early. We tend to get involved pre-LOI. In most transactions, we’re doing all the debt and an equity co-invest. I’ve done five deals as an independent sponsor, and when you’re putting these things together, it’s a puzzle. The pieces of the puzzle come together at the same time you’re doing diligence, legal documents, and everything else to get your deal closed.

At Fidus, when we start looking at the transaction, we’re interested in the debt and a certain amount of equity co-invest. Almost invariably, there are some gaps to fill, and unlike some other capital providers, we are actively assisting with filling those gaps. Given my background as an independent sponsor, I have equity capital relationships with family offices and institutions I brought into the transaction to fund my previous deals. My colleagues at Fidus have been in lower middle market finance for 20-30 years and combined we have deep capital relationships across the country. The benefit of that experience is that when we introduce people to the capital stack, they are people we’ve worked with and act in a logical and constructive manner in both good and bad situations when you need to write another check. There are good reasons to write checks, such as exciting add-on opportunities and growth opportunities, and there are some tougher situations where a macro event has created a chasm we need to cross to grow again while preserving liquidity. We like people who are aligned in that capital stack and play well in the sandbox, so to speak.

Understanding every deal is different, what is your typical approach to economic and governance terms with independent sponsors?

From an economics perspective, it’s interesting. I’ve been in the independent sponsor world for about 7-8 years. When we first started making investments, the economics were all over the place, depending on what you could get done, how attractive your deal was, and who your capital partner was, for instance. In today’s world, if you are partnering with equity providers that are not traditional committed funds, such as alternative equity providers, large family offices, or groups like ours, there’s typically an upfront transaction fee that seems to be in a tight band these days. There’s a management fee with a minimum and a cap, typically a percentage of EBITDA within a tight band. Most commonly, we see MOIC steps in the carry structures. From an economics perspective, I don’t see as much variability in today’s market as I did 6-8 years ago.

On the governance side, it runs the gamut. Just as the independent sponsor world and universe is full of highly experienced people and new, up-and-coming general partners, I see the governance ranging just as much. In a highly experienced situation, it’s basically a blind pool. The independent sponsor controls the business, and there are limited situations where that group loses control. You’re looking to them to continue to drive the boat and work through the situation. The other side of the spectrum is when there’s less experience. I’ve seen board flip mechanisms tied to payment defaults or performance issues, for instance. So, it depends.

Governance conversations in my opinion get overblown in many ways. If you’re ever looking at your legal documents and how the governance works to make this deal go in the right direction, you’re in a bad place. It’s more about partner alignment on the front end. Do you have the same vision for where you’re trying to go? You can be in a very tough situation, but if you’re all aligned, few will enact any board flip or control provisions if they don’t have to because it’s disruptive and generally unhelpful.

From an investor standpoint, how do you determine the appropriate carry mechanism?

It’s more art than science, but if it’s a more favorable transaction (i.e., an attractive deal with an independent sponsor who knows the space and has a proprietary deal), and based on comps and previous deals in the industry, we’re pretty sure they’ve got a very attractive entrance multiple, that may merit a more aggressive carry structure to the independent sponsor because some degree of value creation has already occurred on the front end. You can’t really bake that in; it’s one of those know-it-when-you-see-it situations, having been in the business a long time. Most situations fall into a relatively tight band of graduating carry percentages based on LP MOIC.

What is the current environment for independent sponsor transactions?

In general, the number of independent sponsors continues to grow, and their quality continues to increase. The number of principal-level folks or managing director-level folks I see leaving larger funds to go out on their own is more than I saw 5-7 years ago. Those tend to be high-quality groups.

One of the things we’re seeing, partially because of that and partially because of the overall maturation of the independent sponsor world, is a trend toward favoring quality deals. Valuation is still important, and there’s always a niche for value deals. However, at Fidus, we would rather have a quality business at a reasonable valuation than a hyper-cyclical business with a short operating history or another red flag at a low valuation. We gravitate towards quality, and I’m seeing more independent sponsors doing that too.

So, what does that mean? Some of those businesses are harder to find on a proprietary basis. If you find them on a proprietary basis, you still have to pay a reasonable multiple because it’s tough to find a quality business with an owner who doesn’t understand what they have in terms of value. As part of this evolution towards quality, we’re seeing more of these independent sponsors participating in boutique investment banking auctions in good niches where they know the people and industries well. They’re winning the deal and are seen as a very reputable potential buyer in the transaction due to their track record and industry expertise. In general, there’s a willingness to increase valuations and leverage to acquire higher-quality assets.

Are you seeing increased competition among capital providers for independent sponsor-led deals?

Yes, absolutely. More folks are realizing that if you want to play in the lower middle market, you need an independent sponsor strategy because the ecosystem is taking more market share. More capital providers are realizing you can de-risk your strategy by working with the best independent sponsors and working in sectors that you know well. We’re seeing groups like Fidus now putting a real effort into increasing investment activity in the space with enhanced solutions they can offer independent sponsors. That’s going to continue for the foreseeable future in my opinion.

What makes Fidus different?

One of the things that differentiates us is our ability to scale. I funded my deals as an independent sponsor with family offices, institutions, and SBICs, and that was great. But we can scale more than some others because of our size and diverse capital pools.

Another is our historical DNA from working with established private equity funds with committed capital. That’s a high-paced, high-service, and competitive cost-of-capital market, and you need to be willing to roll up your sleeves and help them with their value creation plans. We bring that same DNA to this market.

I’d also add that it’s a bit of a differentiator having someone like me, who’s been on both sides of the table. When I talk to independent sponsors, they know that I get it because I’ve “made the sausage” before. I know what they’re going through.

For more information on Brien Davis, visit his bio. For more information on Fidus Capital, visit their website.

To read other articles in this series, please see here: Insights | LP (lplegal.com)

Interested in participating in a future interview series? Please contact Robert Connolly.