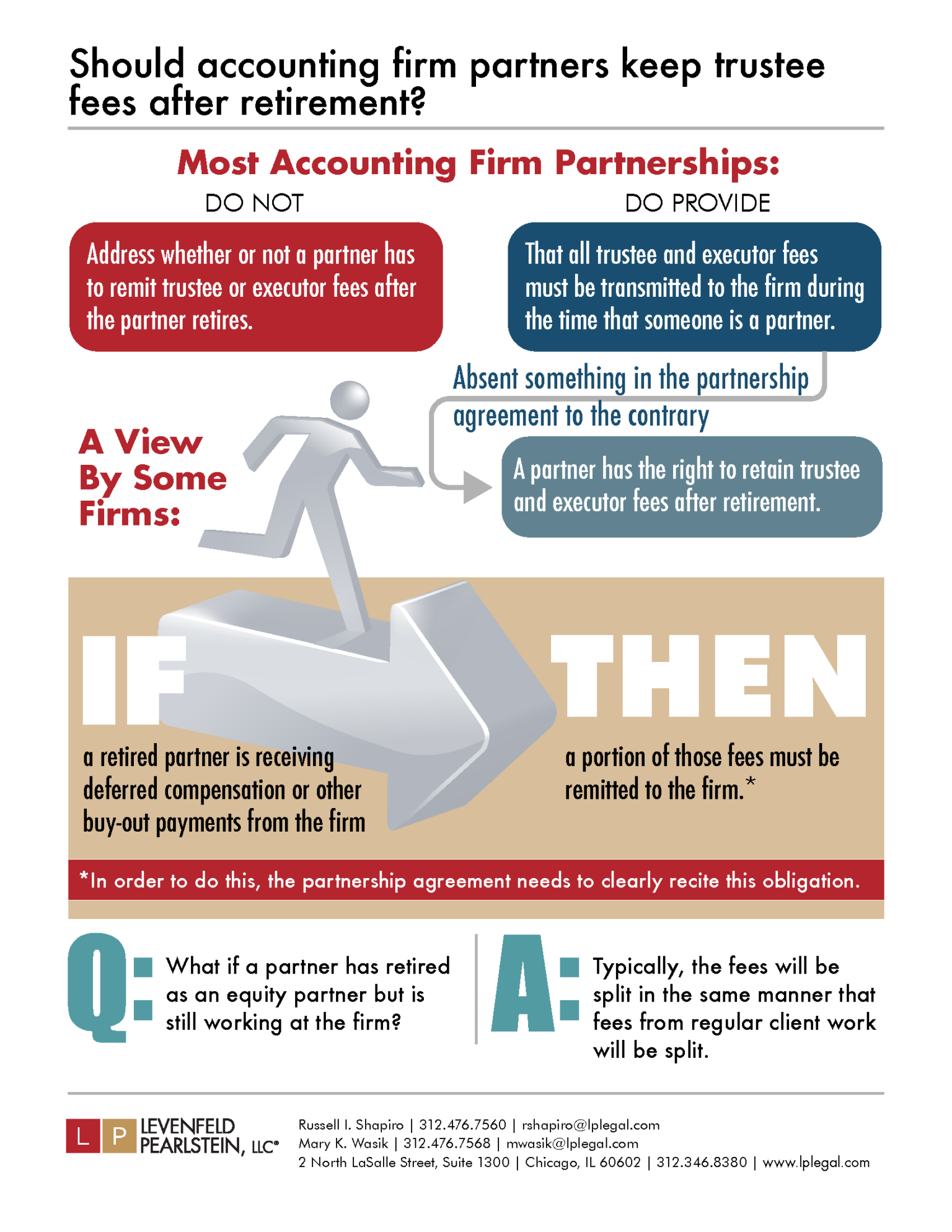

Infographic: Should Accounting Firm Partners Keep Trustee Fees After Retirement?

After the champagne has been popped and the cake has been cut, your firm might be wondering whether its newest retired partner will be able to keep the trustee fees that used to be remitted to the firm. It is not alone. Many firms have questions about who is entitled to keep trustee fees after a partner retires. Does your partnership agreement specify whether trustee and executor fees need to be remitted? What if the partner is receiving deferred compensation payments? Every situation is different, but hopefully the graphic below will provide some useful information.