M&A Insights and Outlooks: A Conversation with Katie Balson of Origin Merchant Partners

To help businesses, investors, and deal professionals better understand the evolving M&A market, Robert Connolly – a partner in and leader of LP’s Corporate Practice Group – shares a series of conversations with M&A experts. Below is his conversation with Katie Balson, a Director at Origin Merchant Partners, a top M&A advisory firm headquartered in Toronto with offices throughout North America. Katie shares insights on the current state of the M&A market, especially the lower middle market (broadly defined as businesses with an enterprise value under $250 million). She also provides updates on deal activity, valuations, and financing availability, discusses what is on the horizon, and provides advice on how sellers can position themselves for M&A success.

Katie has over 15 years of experience in middle-market investment banking. Before joining Origin Merchant Partners, Katie worked at E&Y Corporate Finance, advising numerous industrial product companies serving a range of end markets. Her recent transaction experience includes the sale of a sheet metal fabricator and the cross-border sale of an HVAC controls manufacturer.

The responses below have been edited slightly for brevity and clarity.

Market Overview

How would you describe the current state of the lower middle market M&A environment?

The market has been in a slump since rates started to rise in 2022, but the U.S. middle market seems to have bottomed out. Even though deal volumes and values are still down materially from their peak, they’re largely unchanged for the past three quarters. The consensus is that the market is expected to rebound as pent-up demand builds. What I want to stress here is that even though the Fed has not cut rates, their decision to hold rates steady has reduced uncertainty – and that’s key. The M&A market hates uncertainty, and investors seem to have adjusted to the new level of rates.

The outlook is positive, and many opportunities that were delayed last year are expected to hit in the second half of this year. In addition, the upcoming election may accelerate deals that are already in the market because they hope to close before the election to reduce that uncertainty even further.

What are the biggest opportunities you see for investors in this segment?

There are still attractive buying opportunities for disciplined investors with a clear strategy. By mixing organic growth with a robust investment program, buyers can create scale and multiple growth for exit.

What impact do you foresee from macroeconomic trends on the lower middle market?

In general, there’s a positive economic picture right now with greater economic stability. The stabilization of interest rates, inflation, and unemployment rates has led to GDP growth over the last year. That’s providing a positive environment. Corporate profits also grew last year, which provides more capital for acquisitions by strategics. I think it’s generally positive news.

Are there any emerging sectors or industries that you believe will drive future M&A activity?

In terms of industries or trends in certain sectors that will drive activity, artificial intelligence (AI) is so prevalent in the marketplace. There hasn’t just been an emergence but an explosion of AI. This explosion of AI and data in general has caused a significant increase in demand for computing power and storage. This is going to drive the market for data centers. In fact, in the industrial sector, we’ve seen an uptick in activity for data center infrastructure.

In the long term, AI will become a disruptive force in many different industries. It’s going to cause companies to either build or acquire technology to become more efficient or risk being purchased – which will drive M&A activity.

Deal Activity

What sectors or industries are currently seeing the most M&A activity in the lower middle market?

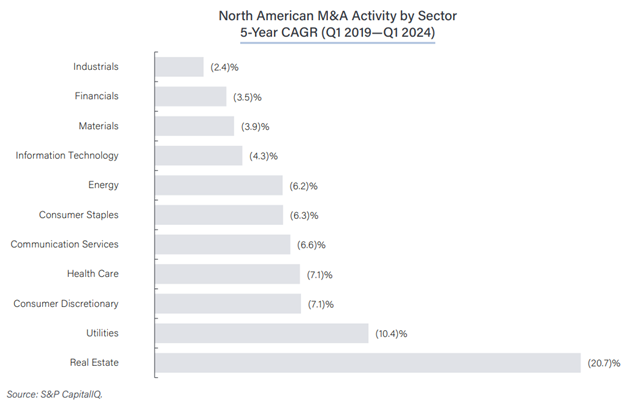

The industrial market – where I do most of my work – has been relatively stable. Compared to pre-pandemic levels in 2019, industrials have only had a 2.4% decrease in volume – the least of any of the major sectors.

The resilience of the industrial market is due to several things. Reshoring, or bringing more of the supply chain to the U.S., is helping to boost activity. For domestic industrial companies, investments in automation are helping with margins, making those companies more attractive. Favorable energy pricing, especially relative to foreign competitors, has also helped boost margins. And continued economic growth is helping manufacturing.

In the manufacturing sector, we look at the Manufacturing Purchasing Managers Index (PMI), which is a forward-looking metric that gives guidance on the outlook of industrial and manufacturing sectors. If the Manufacturing PMI is below 50, manufacturing is in contraction mode; if it’s over 50, expansion is expected. Virtually all last year, the Manufacturing PMI was indicative of contraction, but starting in January of this year, the index rebounded. In fact, the Manufacturing PMI has been 50 or greater in each of the six months for which data is available in 2024. I see industrials continuing to receive strong interest from investors.

Are there particular types of deals (e.g., roll-ups, carve-outs) that are more prevalent right now?

Even though the market has been in a downturn, carve-outs were still relatively strong in 2023, partly due to the uncertainty in the market. Companies were seeking to maximize their cash and hedge risks until things became more stable. Large companies have been refocusing on their core strategies and shedding non-core assets.

Valuation and Pricing

How are valuations trending in the lower middle market?

Average multiples were lower in 2023, but they began to increase in the second half of last year. Generally, I think buyers and sellers have had diverging expectations. Sellers were looking for post-pandemic M&A boom numbers, and buyers were pricing based on an expected recession. The gap is closing as both sides become more realistic.

It’s still an attractive operating environment. High-quality opportunities have continued to generate attractive multiples as they do in any market; in a bad market, they just stand out even more.

Financing and Capital Availability

What’s the current state of financing for lower-middle market deals?

On the private equity side, right now, there’s almost $4 trillion in dry powder. Private equity firms need to deploy their capital and deliver returns to investors, especially following a slow period. They have a mandate to make investments.

Corporate balance sheets reflect record levels of cash, so strategic buyers are also poised to grow through M&A.

And there’s also family office capital, which seems to continue growing every year. One statistic shows that the number of family offices more than tripled between 2019 and 2023. The number of ultra-wealthy families has grown, and they’re looking for ways to preserve and grow their wealth for future generations. One of the nice things about family offices is that they have very patient capital, which is attractive to many sellers – especially sellers who want to stay on with the business. Additionally, because the capital is self-committed, they’re not constantly raising more money.

How are changes in interest rates affecting deal financing and structures?

As mentioned before, changes in interest rates affect deal financing. Interest rates declined in the decade leading up to the pandemic so, of course, current rates seem relatively inflated. In reality, if you look at them in an overall context, historically, interest rates are still relatively low. That said, whenever there’s a change to the status quo, the market must adapt. The immediate impact was a reduction in M&A activity and transactions completed.

The other thing that happens when interest rates rise is increased scrutiny by lenders. That has resulted in a more protracted lender due diligence process when financing transactions, leading to a lengthier due diligence process overall. It’s taking a longer time to get deals done.

Interest rates don’t necessarily need to drop to drive M&A; they just need to become more stable and predictable. Even without rate cuts, activity levels should improve in the market. Interest rates have stabilized for the last three quarters, and people seem to be getting used to the current rates.

Anecdotally related to financing, my private equity contacts tell me the lending market is improving. They are seeing pricing come down slightly as EBITDA ratios normalize, so that’s good news.

Reflection and Insights

Can you share a recent deal that exemplifies the current state of the lower middle market?

A deal I worked on a couple of years ago offers some good lessons for sellers. We were selling a manufacturing business and received a really attractive offer. We were under a letter of intent, in the confirmatory due diligence phase, and the company began underperforming.

A couple of issues were at play. There were rising commodity prices, and the company didn’t really have systems in place to pass those increases through to the customers in a timely way and their margins dropped. They also had trouble pushing product out the door at one of their facilities, which led to some very unhappy customers. The buyer stuck with them for a bit, but ultimately walked away. The company is still trying to right the ship.

The lesson here: be prepared.

Before you go to market, it’s hard to anticipate all the potential performance pitfalls, but it’s good to know that you have systems in place to deal with them so you can respond. You’re never going to be able to predict everything, but you want to respond to issues quickly, especially if you’re in the middle of an M&A process.

Another overarching theme is the importance of keeping momentum during the M&A process. Transaction processes that stick to the established timeline achieve the most successful outcomes. Time is never the friend of the seller.

You want to reduce the impact of macroeconomic factors that could be out of the seller’s control. You want to be really prepared upfront and identify any red flags before the process begins. We rarely have a client that doesn’t have any “hair” on it, whether it’s customer concentration or volatility in their performance. It’s always good to recognize and discuss those issues upfront so that you can mitigate them throughout the process.

One of the other things we do ahead of time with clients is to help them develop their forecasts, making them aggressive but achievable. Not meeting the forecast during the process certainly erodes value and could even kill the deal. So, it’s really important to make the forecast achievable. It’s now standard to have a sell-side quality of earnings report done, especially if the financials are not audited or reviewed. It makes due diligence more efficient with fewer surprises.

What advice would you give to a company considering a sale in the current market?

Preparation is key. Have all your ducks in a row before you start the process. We work with clients upfront before we ever go to market to make sure that everything is prepared so that once we approach buyers, we can keep going and we can build momentum. Time is not on our side.

If there are major changes planned for the business – such as new customers coming in, implementation of new automation, a facility expansion – we want to make sure that our clients have a sustained track record showing the positive impact of those changes so that they can get paid for them. A buyer isn’t necessarily going to pay for a promise; they want to see the fruits of those changes.

Additionally, make sure to secure retention agreements for key members of the management team, particularly those who are critical to the M&A process and the buyer post-closing.

If customer concentration is an issue – which often comes up with our manufacturing clients – there are ways to mitigate the risks, such as long-term contracts and length of the relationship, etc. The key is to address those issues up front and prepare for them.

Another thing that companies can do to prepare is make sure they have a really good idea of their competitive advantages and how they’re positioned in the market. That really helps us as advisors in marketing the business.

Last, but not least, we’re advisors. We do a lot of the heavy lifting, but the owners and management really need to be prepared to devote time to the process to keep it moving since a drawn-out process can be a complete deal killer. We do our part to be responsive to buyers so they’re getting information, but we can’t do it alone, and we need the clients to make sure that they have time to devote to the transaction.

For more information on Katie Balson, view her bio. For more information on Origin Merchant Partners, visit their website.

Interested in participating in a future interview series? Please contact Robert Connolly at rconnolly@lplegal.com.

Filed under: Corporate

Related insights

June 25, 2025

Independent Sponsor Series: Ryan Sullivan of North Park Group Discusses the M&A Outlook and Offers Advice to Business Owners and Independent Sponsors (Part Two)

Read MoreJune 18, 2025