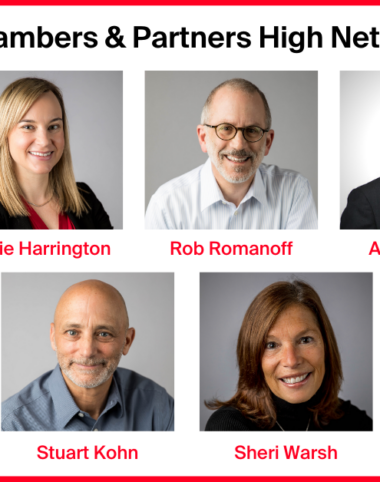

Stuart J. Kohn

Partner

Trusts & Estates

Stuart Kohn is a partner in the Trusts & Estates Group. He concentrates his practice in estate, gift and income tax planning and business succession planning, and has significant experience with complex estate and trust administration matters. Stuart also works with clients to design and implement asset protection strategies.

Stuart routinely works with high-net-worth individuals and their families to ensure their wishes are met with respect to the passing of their wealth. Throughout that process, he works to implement strategies that maximize the value of assets passing to intended beneficiaries, while minimizing the tax impact to the greatest extent possible. Understanding the financial and tax considerations is a key to Stuart’s practice, but equally important is his sensitivity to the emotions surrounding these decisions. Stuart recognizes that clients find comfort in knowing and understanding their options, and works to clearly communicate his planning strategy and resulting considerations.

Stuart is a member of the esteemed estate planning organization, the American College of Trust and Estate Counsel (ACTEC). ACTEC membership is based on professional reputation, expertise in the fields of trusts and estates and on the basis of having made substantial contributions to these fields through lecturing, writing, teaching and bar activities.

Stuart is active in a number of legal organizations and has served as the Chair of the Executive Committee of the Chicago Bar Association’s Trust Law Committee and President of the Board of Directors of the Greater North Shore Estate & Financial Planning Council. He has lectured on advanced estate planning topics for the ACTEC annual meeting, the American Bar Association Tax Section, Jerry A. Kasner Estate Planning Symposium, Notre Dame Tax and Estate Planning Institute, Illinois Institute for Continuing Legal Education, the Chicago Bar Association, and Iowa Academy of Trust and Estate Counsel.

Stuart frequently writes on a variety of asset planning topics. He has written articles which have been published in the notable Bloomberg BNA's Tax Management Estates, Gifts and Trusts Journal and the RIA periodical, Business Entities.

Stuart has been recognized individually in Chambers High Net Worth Guide since 2018, with references noting that he is a “top-tier professional.”

Additional Information

Education & Admissions

Education

- Loyola University Chicago School of Law, J.D.

- University of Michigan, B.B.A.

Bar Admissions

- Illinois

- Arizona

Court Admissions

- U.S. District Court, Northern District of Illinois

- United States Tax Court

Memberships

- American College of Trust and Estate Counsel

- American Bar Association

- Chicago Bar Association

- CJE SeniorLife, Board of Directors

- Greater North Shore Estate & Financial Planning Council

Awards

- Ranked in Chambers High Net Worth Guide 2018-2023

- Illinois Super Lawyer, 2007-2021

- Leading Lawyer, Leading Lawyers Network

Q&A

What are you most proud of?

I have 2 grown sons. Our older son is a systems and information engineer with a double major in economics from University of Virginia, currently working as a Machine Learning Engineer at LinkedIn. Our younger son graduated from Business School – Real Estate Program at University of Wisconsin Madison, and is currently working as an Investment Analyst at Flock Homes.If you weren’t an attorney, what would you be?

Since I was never big enough to be a professional baseball player, I guess I’d say a high school history teacher.What’s the best piece of advice you ever received?

Just be yourself - don’t try to be someone you’re not.